Should You Use Credit Cards?

“You’ll earn cash back and airline miles!” “No, stay away from credit cards. They’re a scam!”

Many people are divided by the question: “Should you use credit cards?” and “What does the Bible say about it?” Let’s take a look and figure this out.

But before we get into that, let’s first see what a credit card is:

Credit cards are, at face value, straightforward. You borrow money from a bank, pay off what you spent at the end of the month, and receive cash-back rewards, sometimes even airline miles.

People can use these rewards to make a small profit: $1.50 per $100 spent with 1.5% cash back and $2.00 per $100 spent with 2% cash back. Airline miles work similarly to cash back, providing an average of 1-2 miles per dollar spent, which can be used for plane flights.

Your credit score, which allows you to spend a pre-determined amount, can be built up through responsible use and timely payments. Conversely, it can be lowered by making late payments or using your credit irresponsibly, reducing your spending limit. Several credit cards come with insurance for products purchased with them. One very important detail is that you must pay the bank interest if you are late on credit card payments.

Now that we know the basics, let’s dive in!

Should you use credit cards?

Credit cards seem like a good idea, right? Only if you understand how to control yourself regarding them. Proverbs 25:28 says, “A person without self-control is like a city with broken-down walls.” This verse applies wonderfully to credit cards.

Credit cards can encourage you to spend more money than you would otherwise because you are not spending your own money but the bank’s. There is no emotional connection to it. You must control your spending and not spend more than you can pay off as you spend it. Budgets are great for this!

“So what if I spend a little extra? I’ll get rewards and have enough money to pay it off by the end of the month.” But stuff happens; “Uh oh, flat tire.” “The air conditioner just broke.” These things can put you behind on payments and into debt. This is what may happen if you can’t afford your purchase as you make it. To prevent this, save up a couple of thousand dollars to hold in reserve.

What About the Bible?

While they didn’t have credit cards back during the Bible days, people gave loans and had interest rates. Leviticus 25:35-37 says, “If any of your fellow Israelites become poor and are unable to support themselves among you, help them as you would a foreigner and stranger, so they can continue to live among you. Do not take interest or any profit from them; you must not lend them money at interest or sell them any food at profit.”

Often, people with unstable or low incomes rely on credit cards to get by, but it isn’t God’s best for anyone to live like that. Romans 13:8 says: “Let no debt remain outstanding, except for the continuing debt to love one another, for whoever loves one another has fulfilled the law.”

Helping other people by leaving a large tip or lending money (without interest) is unattainable with debt. After reading that, you may be thinking, “Why even use a credit card? They should be avoided!” Financial adviser Dave Ramsey of Total Money Makeover says this. But is it the truth for everyone? While avoiding the risk of owning credit cards can be beneficial, it isn’t always necessary.

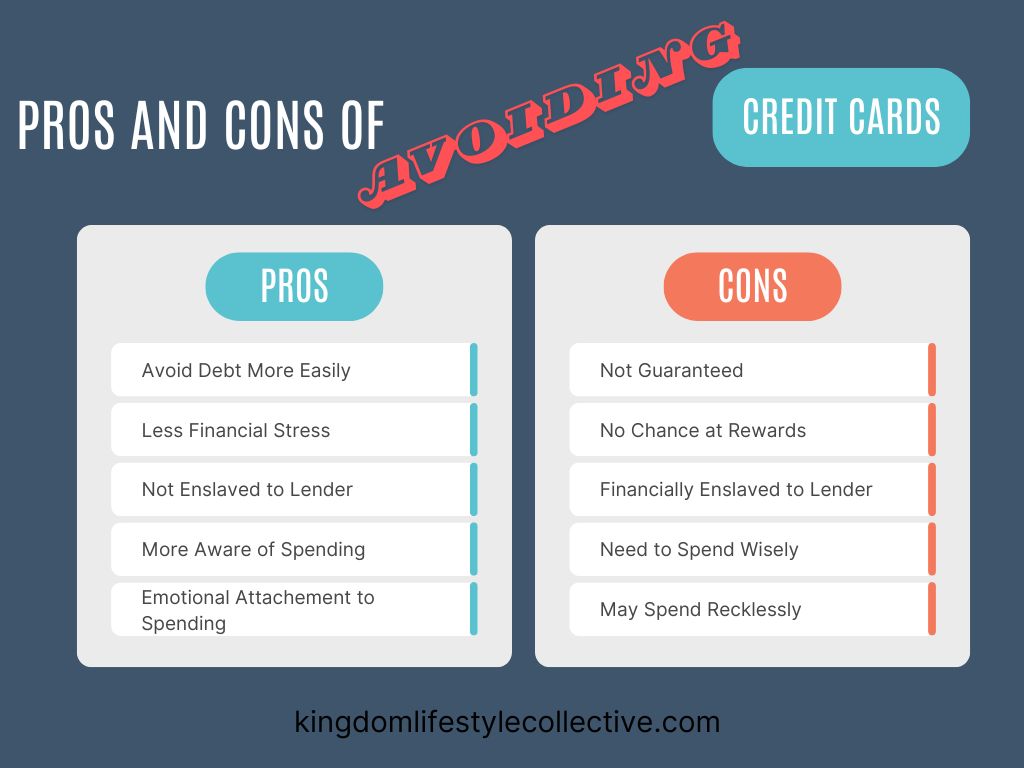

Now, let’s list some pros and cons of avoiding credit cards:

Pro #1: It is significantly easier to avoid falling into credit card debt.

Con #1: This can be difficult to maintain.

Pro #2: You will have less finance-related stress, enabling you to spend better family time with less stress.

Con #2: You will miss out on rewards. This is self-explanatory.

Pro #3: “The borrower is a slave to the lender” (Prov 22:7) will not be a problem. You will be free financially.

Con #3: “The borrower is a slave to the lender.”

Pro #4: You will be more aware of your spending and, therefore, wiser.

Con #4: You will have to be smarter with your spending, which can be difficult to transition to.

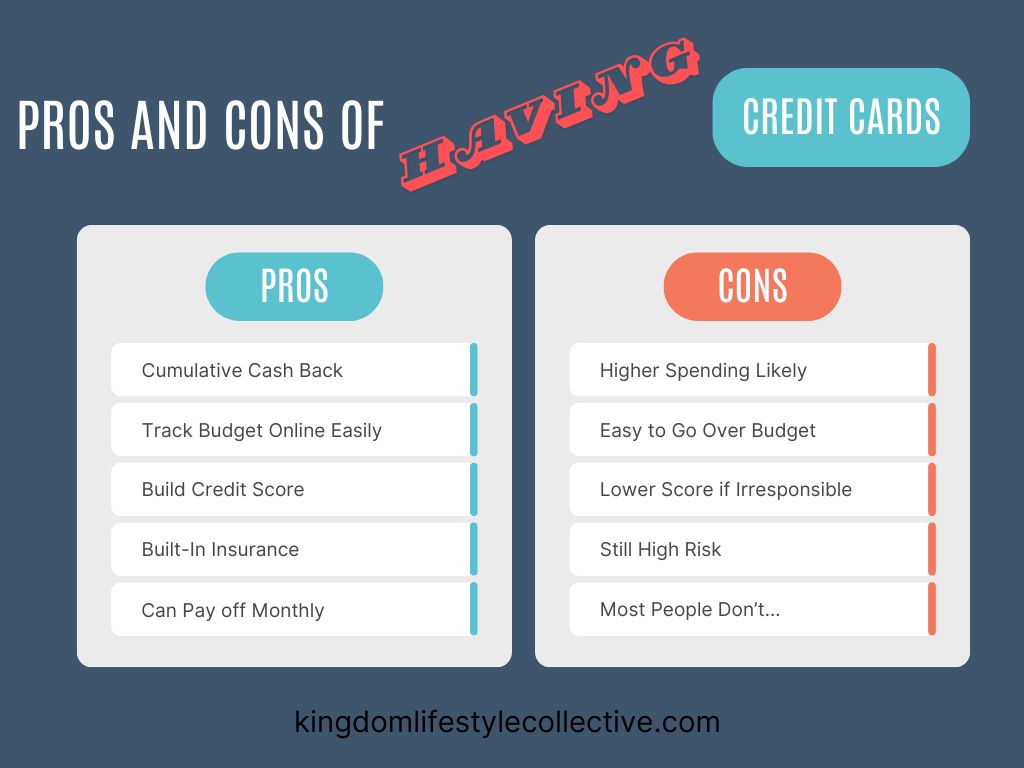

But what about having a credit card? Let’s see some pros and cons of keeping a credit card:

Pro #1: Rewards. While cash-back is a tiny percentage, it can accumulate, and airline miles can be a great way to save money. These things will not make you wealthy, though.

Con #1: You are more likely to spend more. This can lead to many issues, including cumulative debt.

Pro #2: Credit cards work well with a budget. Just make sure you have some additional money saved for unexpected costs or repairs.

Con #2: Credit cards take a lot of work to use wisely.

Pro #3: Responsible use will build your credit score.

Con #3: Irresponsible use will lower your credit score, potentially harming your budgeting and rewards.

Pro #4: Insurance over your purchases. Very self-explanatory.

Con #4: They are incredibly risky at times. Make sure to make your payments on time!

Now that we’ve taken a look at credit cards, let’s answer the final question:

Should you use a credit card?

Ultimately, there is no “Yes” or “No” answer; it is up to you. Are you responsible enough to be wise and be a good steward? A credit card isn’t a convenience hack; it’s a responsibility, and it must be used with wisdom—wisdom to avoid debt, wisdom to avoid biting off more than you can chew.

More Like This: Healthy Habits to Payoff Debt and Build Wealth