In an age where digital transactions are king, the concept of a cash-based budget might need to be updated. However, as we navigate through 2024, more people are discovering the benefits of this traditional approach to financial management. Here’s how you can harness the power of a cash-based budget to achieve financial freedom.

Understanding Cash-Based Budgeting

A cash-based budget is a financial strategy where you use physical cash for most, if not all, of your transactions. This method lets you physically see and feel your money, making you more aware of your spending habits.

**This post may contain affiliate links; when used to purchase items, we receive a small commission at no additional cost to you!

The Benefits

1. Enhanced Spending Awareness: Handling physical cash can heighten your spending awareness, reducing impulsive purchases.

2. Simplified Expense Tracking: Cash transactions simplify tracking your expenses.

3. Debt Reduction: A cash-based budget can help reduce existing debt and prevent new debt by limiting credit card usage.

Getting Started in 2024

1. Assess Your Income and Expenses: Start by calculating your monthly income and listing your expenses. In 2024, consider the inflation rates and changing economic landscape while doing this.

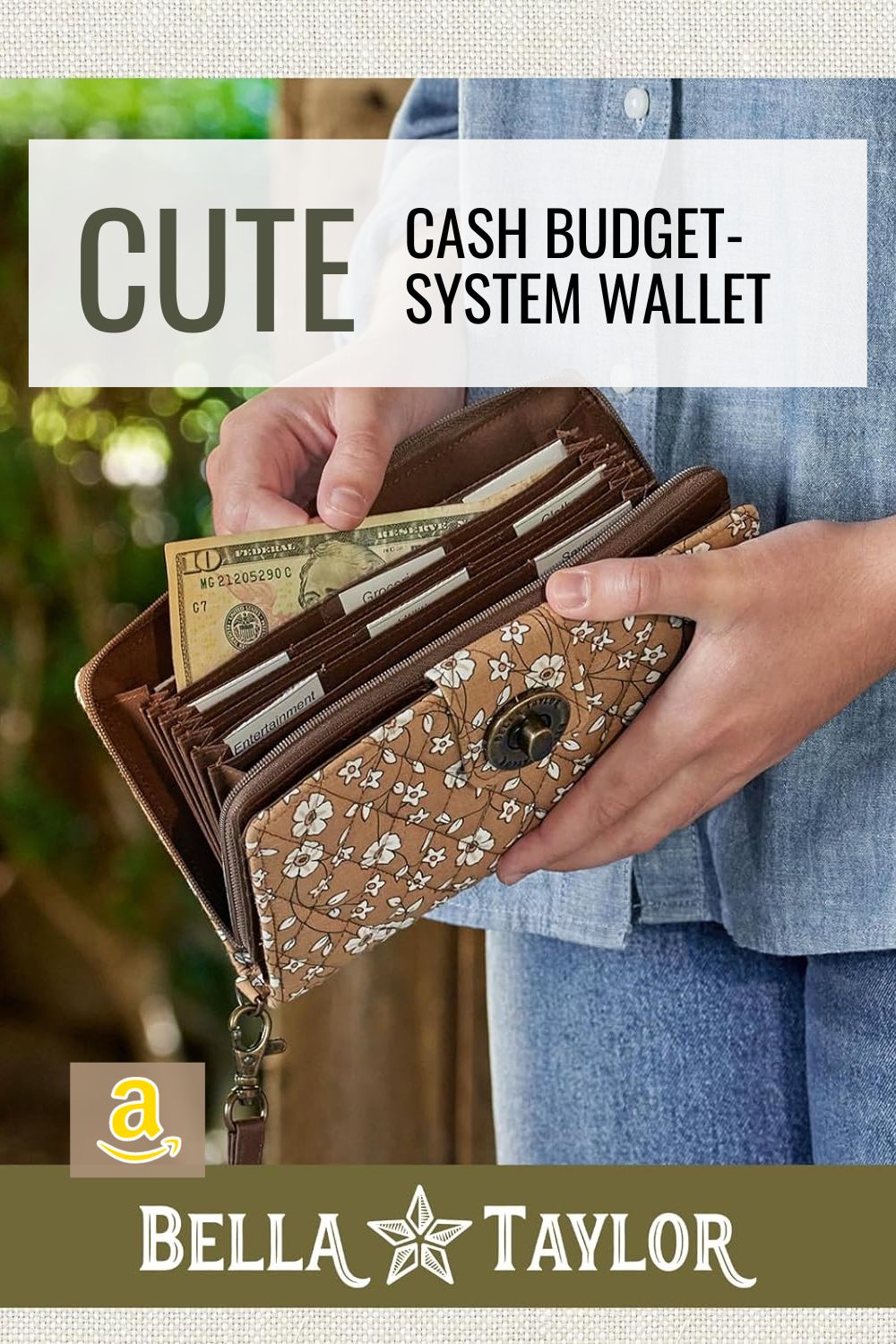

2. Create Spending Categories: Divide your expenses into categories like groceries, utilities, entertainment, and transportation.

3. Allocate Cash for Each Category: Based on your assessment, allocate a set amount for each category. You can use the 2024 cost of living as a guide to adjust your allocations accurately.

4. Use Envelopes or Cash Jars: Label envelopes or jars with each category’s name and place the designated cash amount in them. This is your budget for the month.

5. Track Your Spending: Regularly monitor the cash in each envelope. This practice helps identify spending patterns and areas where you can cut back.

6. Adjust as Necessary: Be flexible and ready to adjust your budget, especially considering the economic fluctuations in 2024.

Embracing Technology with Traditional Budgeting

While adopting a cash-based budget, don’t shy away from technology. Use budgeting apps to track your overall financial health. However, ensure that these digital tools complement your cash-based strategy.

Overcoming Challenges

1. Safety Concerns: Carrying cash can raise safety concerns. You can only carry what you need and use bank services regularly to deposit or withdraw cash.

2. Convenience of Digital Transactions: In 2024, where digital transactions are more convenient, carrying cash might seem cumbersome. Balance this by using cash for daily expenses and cards for more extensive, infrequent purchases.

Conclusion

A cash-based budget in 2024 might seem like a step back in time, but it’s a powerful tool to regain control over your finances. It encourages disciplined spending, reduces debt, and enhances saving habits. As we embrace the new financial landscape of 2024, consider giving this traditional budgeting method a try for a more grounded and mindful approach to managing your money.

For tips on how to increase your earnings this year read our Profitable Blog Series